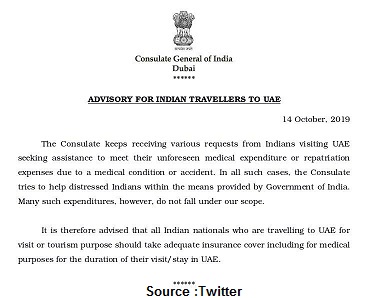

In a fresh advisory issued on Twitter on Monday, the Indian consulate in Dubai advised its citizens to buy insurance before heading to the UAE.This travel insurance will cover expenditures just in case of an emergency.

The advisory said “The consulate keeps receiving various requests from Indians visiting UAE seeking help to fulfil unforeseen medical expenditure or return expenses due to a medical condition or accident.’’

Many cases have come to light where people travel UAE with no insurance. It doesn’t matter until the person falls ill, is a victim of an accident or, worse, dies while in the host country. Medical costs can quickly rack up against the traveller and his/her family, not to mention repatriation costs.

Repatriation costs alone to India can range around Dh30,000, this in addition to medical expenses in case of an illness or accident can rise to hundreds of thousands – leaving family members, friends and even well-meaning social workers in a lurch.

A policy can cover, to certain limits and based on the policy purchased, medical expenses, repatriation costs, cancelled visas etc. From medical costs to lost baggage cover, a policy ensures fast and cost-effective coverage for anything that might happen during a trip.

A travel insurance policy can be purchased online for as low as Dh55 for a short trip, around Rs 1,000. For a higher amount, for example Rs 3599 or Dh185, you can get covered for three months (standard UAE visit visa term) for an insured sum of US$50,000 – around Dh183,660. This policy covers medical expenses (up to insured limit) and also covers interruptions or cancellation of flights or baggage loss (except those caused by policy-holder).

SAMPLE COSTS FOR A 31-DAY TRAVEL INSURANCE (INDIA TO UAE)

For 60-year-old travelers

- Dh65.10 to Dh76.60 (Depending on the policy provider and plan)

- Coverage: $100,000

Includes:

- Flight cancellations, delays and sudden change in plans

- Pre-existing diseases

- Baggage and passport loss

- Personal accident and personal liability

- Quick claim settlement with cashless options

For 64-year-old seniors

- Dh89.80 to Dh172.60 (Depending on policy provider and plan)

- Coverage: $25,000-$100,000

Includes:

- Medical advice on the phone while traveling

- Arrangement of hospital admission

- Medical repatriation

- Medical evacuation

- Emergency cash advance, etc.